https://ift.tt/37mUoHH

The start of 2020 has seen considerable gains in the cryptocurrency market as a whole. Recently, Bitcoin (BTC) price reached a 2-month record high crossing above the $9,000 mark as well as other cryptocurrencies such as Litecoin (LTC) reaching $62.80 which is the highest price seen since mid-November 2018.

Cryptocurrency market weekly overview. Source: Coin360

Cryptocurrencies’ volatile behavior is one of the main concerns raised by researchers and it complicates the argument that Bitcoin should be classified as a traditional investment asset and that it is a reliable store of value.

Amid those discussions, Bitcoin has been closely compared to gold, while Litecoin has been associated with being “the silver to Bitcoin’s gold.”

As reported by Cointelegraph, new data suggests that the actual correlation between Bitcoin and gold is not significant, as well as gold’s explanatory power of Bitcoin returns. Nevertheless, Bitcoin is still frequently compared to gold, particularly as a potential safe-haven asset.

Since October 2019, silver prices have approached new record-highs. But does the latest data support the argument that Litecoin is the silver of cryptocurrencies? Could Bitcoin instead of Litecoin be closer to silver than to gold?

Silver prices since October 2019. Source: BullionVault

Is Bitcoin or Litecoin price action closer to silver?

Our data — from May 2013 until December 2019 — shows that Bitcoin and Litecoin returns are very positively correlated (0.67) with 1 implying a strong positive correlation and 0 meaning that the assets are not correlated. A reading of -1 shows that the assets are completely inversely correlated.

Meanwhile, the correlation between silver and Litecoin returns is close to zero (0.026), which is similar to Bitcoin’s correlation with silver (0.0025).

We further analyzed the correlation between the lagged silver returns and the two assets. In other words, the correlation between yesterday’s silver returns and today’s Litecoin and Bitcoin returns were compared.

However, the results are even more discouraging, since both show negative correlations with the lagged silver returns. Bitcoin’s correlation was -0.03 while Litecoin’s was -0.05.

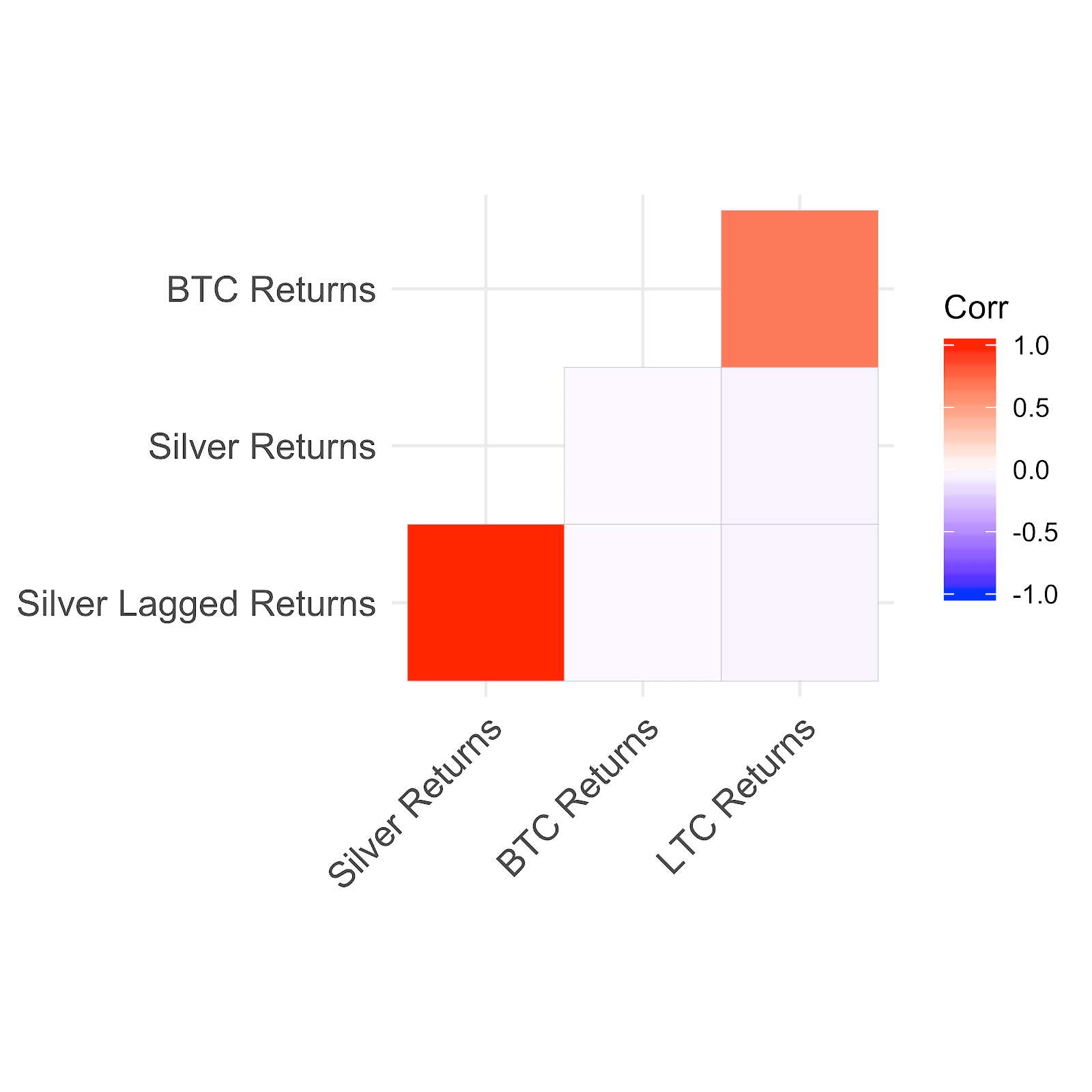

April 2013-December 2019 correlation between silver, Bitcoin and Litecoin returns and silver’s lagged returns

Analyzing the rolling correlations provides a wider view and each data point in the diagram above refers to the correlation of silver and Bitcoin returns (BTC/silver), and between silver and Litecoin returns (LTC/silver) over the last 30 days.

One can see that the correlation between Bitcoin and silver, and Litecoin and silver, is very similar across time during both negative and positive periods.

Rolling correlations between Bitcoin/silver, and Litecoin/silver from May 2013-December 2019

Hence, both Bitcoin and Litecoin have a small correlation and similar relationship with silver. Thus, the Litecoin as “digital silver” narrative is challenged by these very low correlation values. Moreover, it’s no surprise that Bitcoin has surpassed both Litecoin and silver as the best investment option over the past ten years.

Cumulative Bitcoin, Litecoin and silver returns from investments made between May 2013 and January 2020

The relationship between digital assets and commodities from 2018 and 2019

For investors, a closer look at these relationships over the short-term can help draw better insights for future investment strategies. In 2018, the correlation between silver for both assets is slightly higher than the first results from May 2013 to December 2019, albeit still very low. Bitcoin is correlated at 0.05 with silver and Litecoin is correlated at 0.09.

Whereas in 2019, Bitcoin and Litecoin had opposite correlations to silver with Bitcoin and silver correlation being 0.03 and the Litecoin and silver correlation being negative at -0.02. Even the correlation between Bitcoin and Litecoin returns is lower than in other samples (0.74).

Nonetheless, both results are very close to 0, which leads us to believe that the correlation between these assets is not representative enough to draw reliable strategies for investors.

Correlation in 2019 between Silver returns, BTC returns, and Litecoin returns

Is silver a useful predictor of Litecoin and Bitcoin returns?

The data, however, suggests that silver returns may work as a predictor for future Litecoin returns. From the model employed, if silver’s return rose by 1% yesterday, we can expect that Litecoin returns may decrease by -0.232% today. This statistically significant result can lead investors to assume that silver returns may work as a predictor for future Litecoin returns in a negative way. Similar outcomes were not found in the case of Bitcoin, however.

The ability to predict prices has been the holy grail of financial markets, hence the importance of this relationship between returns. Even though both crypto assets show a very low correlation with silver, the results for the lagged returns shed some light on the relationship between silver and future Litecoin returns.

Looking forward, investors may want to look at silver returns to draw strategies when buying/selling Litecoin based on this past silver return’s analysis. However, any strategy has to consider the fast-changing crypto market environment and careful analysis over different time periods, which can cause different conclusions.

Nevertheless, these findings can help us to conclude that Litecoin as the digital equivalent of silver is far-fetched due to the low correlations. However, we do highlight the value of investigating the digital silver narrative by establishing a new connection between returns, which is crucial for investors.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Комментариев нет:

Отправить комментарий