https://ift.tt/2QQLHPq

We’re on the verge of a massive market rebound after the COVID-19 correction.

But not every company will make it.

Our nation’s future is in America 2.0. And to create something new, the old has to go.

One such company is General Electric Co. (NYSE: GE).

Paul Mampilly added this blue chip to his “blacklist” — 100 companies to sell.

Old-world companies like GE have only one destination. Zero.

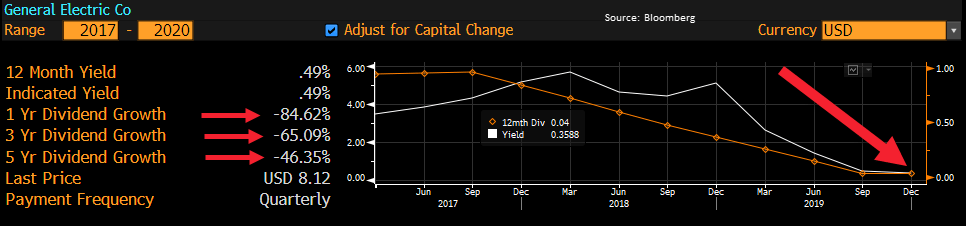

Since 2017, GE’s 12-month dividend yield has collapsed 96% from $0.96 to $0.04. Its 12-month dividend growth rate is -84.6%.

If you own GE, remember to wait to sell high to get the most for your stock. Even the worst stocks will see a bit of a bounce after the COVID-19 dip.

But right now, the markets are trading at a discount. That means it’s an even better opportunity to buy into our mega trends at rock bottom prices.

We believe the companies in America 2.0 are unchanged. And they are going to bounce back stronger than ever.

To see how Paul spots the signs of a rebound, watch this video. In it, he reveals his No. 1 strategy for locking in rebound profits in the COVID-19 market correction:

Keep reading for the best opportunities that the Bold Profits team found this week to put the rebound strategy to use!

Buy for America 2.0 With Coronavirus Rebound Opportunities

Here’s why our team is still #BOP (bullish, optimistic and positive!):

Regards,

Your Bold Profits Team

Комментариев нет:

Отправить комментарий