Timor Invest

https://ift.tt/2tjSGb2

Even though the cryptocurrency industry is not new to ups and downs, 2019 has turned out to be the year with the most surprising reveals. The long-lasting bear market of 2018 moved market analysts to call it the year of regulatory reckoning, leaving many jurisdictions uncertain about how to treat cryptocurrencies.

However, 2019 also turned out to be the year of the comeback, as big tech giants like Facebook moved from banning crypto to embracing it.

Escalating global events such as the trade war between the United States and China have shifted investors’ point of view on the utility of cryptocurrencies like Bitcoin, but there is still a lot to be done even as the U.S. Securities and Exchange Commission continues to turn down every other Bitcoin ETF proposal.

As the year comes to a close, here is a look at the companies, individuals and various crypto projects that managed to come out on top in 2019, as well as those that failed to mark the year as a positive in their books.

The winners

Bitcoin’s double growth

This year, Bitcoin and the entire blockchain and cryptocurrency industry celebrated its tenth anniversary as proof of the resilience of Satoshi Nakamoto’s creation. However, at the beginning of 2019, the cryptocurrency industry was just recovering from the so-called crypto winter of 2018.

Fortunately, Bitcoin kicked off the year with a bullish trend that resulted in an approximate price increase of 11% higher by the end of the first quarter. Anthony Pompliano, the co-founder of Morgan Creek Digital asset management firm, shared his view with Cointelegraph:

“Bitcoin’s price is up significantly in 2019 [as there are] more buyers than sellers on a net basis this year.”

As the trading volume and market capitalization increased throughout the second quarter of the year, Bitcoin led the market with a 165% gain as its price surged from $4,103 to $10,888. Furthermore, Bitcoin’s market dominance increased from 54.6% to 65%.

Among the reasons that have promoted Bitcoin’s continued growth despite a struggling market is the view that the digital currency can act as a hedge in the wake of increasing global uncertainty. This year, the U.S.–China trade war saw most investors look to Bitcoin and gold as hedges. Pompliano also told Cointelegraph that there were other contributing factors:

“The biggest moments probably revolve around the announcement of Libra and the subsequent reactions, both positive and negative, from various folks across the traditional and cryptocurrency markets.”

However, it was not all sunshine for Bitcoin in 2019. Over the third quarter of the year, a bearish outlook emerged as Bitcoin’s price decreased significantly as 100 billion in market capitalization was lost. Fortunately, even as the market struggled to gain ground against the bears, Bitcoin not only closed the quarter with the least amount of loss but also increased its market dominance by 5.4%. Ultimately, of all cryptocurrencies, Bitcoin’s performance has been the best so far.

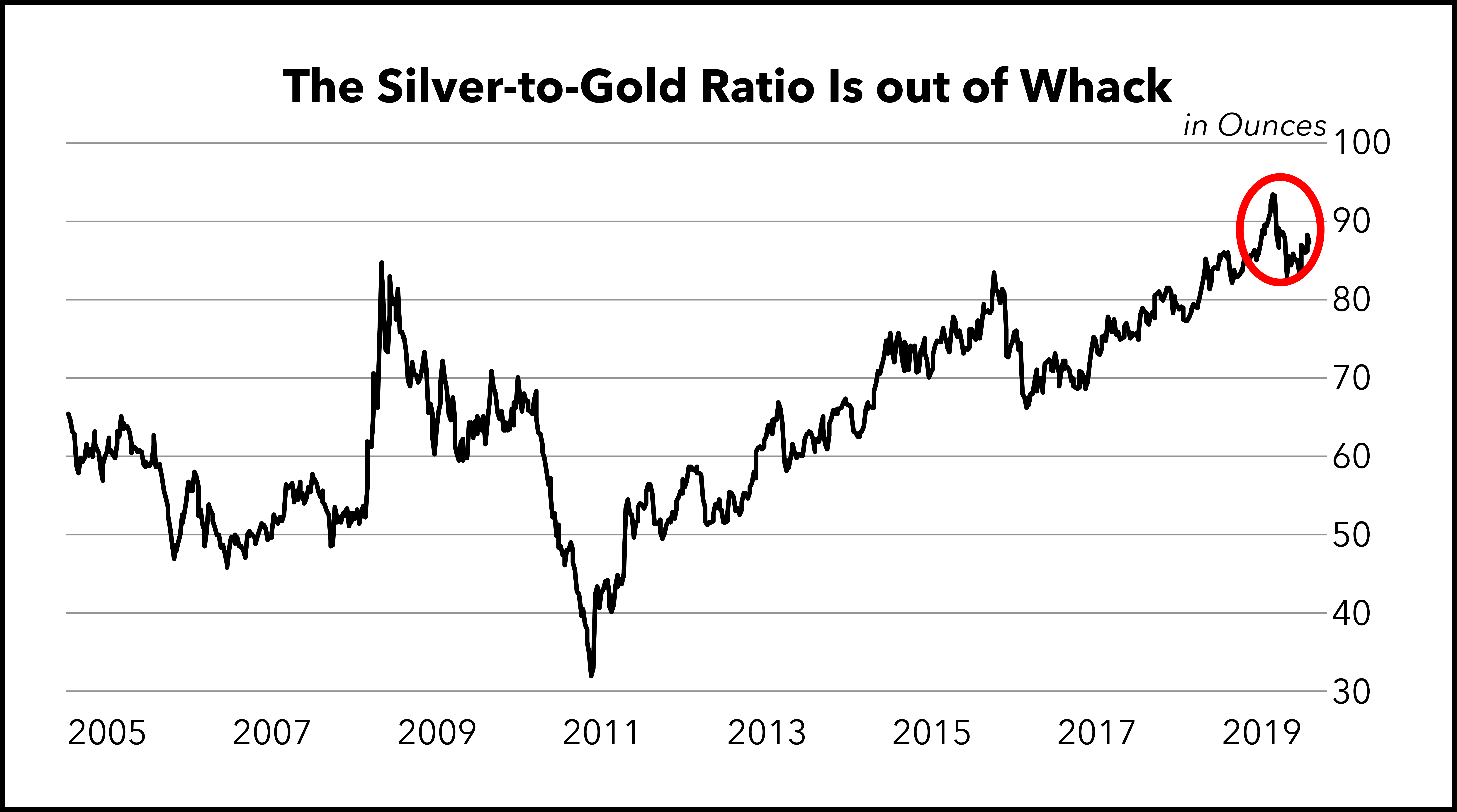

Compared to assets from other markets, Bitcoin’s performance throughout the year is still far from tenuous. For instance, even though gold is regarded as a reliable store of value, its price has only increased by 17% since January. Even the S&P 500 Index, although with an excellent performance of +21%, is still dwarfed by Bitcoin’s growth throughout the year. Beyond price, Bobby Lee, CEO of the Ballet crypto wallet, told Cointelegraph that Bitcoin has benefited from several major technological developments:

“2019 was a great year for Bitcoin bulls because of the advances in the open-source ecosystem. Lightning Network is increasing Bitcoin’s transaction capacity, wallets with built-in, user-friendly features (Wasabi, Samourai) are improving privacy.”

Gods Unchained’s rise to popularity

According to reports, Gods Unchained, a blockchain-based virtual card game built on Ethereum, emerged as one of the highest-grossing and most popular blockchain games in 2019. This came about after the platform completely sold out its Genesis Card Pack to the tune of about $6.2 million. This came about after Blizzard, the creators of Hearthstone (a digital trading card game) banned Hearthstone player Chung Ng Wai (also known as Blitzchung) for expressing support for the Hong Kong protests. The Hearthstone game developer also stripped Blitzchung of his winnings.

In addition to the backlash received from the gaming community, Blizzard’s actions were criticized in a tweet by Gods Unchained that claimed Blizzard “care[s] about money more than freedom.” Gods Unchained also promised to compensate Blitzchung for his lost winnings while offering him an invitation to their $500,000 tournament.

Related: Blizzard Bans Hearthstone Player, Blockchain Comes to Rescue

The tweet by Gods Unchained was retweeted over 10,000 times, and Google searches for the game have since surged. Unlike Hearthstone, Gods Unchained is decentralized and uses blockchain to ensure that players truly own in-game items and have the freedom to trade them at will.

In a move to give online game players long-term incentives, James Ferguson, CEO of Gods Unchained said that the game is “leveling up the outdated practices of the gaming industry.”

Coinbase’s continued expansion

In the past, Coinbase maintained a reputation for employing a rather selective strategy for adding coins to its exchange. As one of the big league exchanges in the crypto space, Coinbase is also known for having significantly fewer large-scale hacks. In a year that saw other major exchanges like Binance fall victim to large scale security breaches, leading to the loss of thousands of Bitcoin, Coinbase stands out as a reliable and safe platform.

However, the company was heavily scrutinized by Twitter users this year over its acquisition of Neutrino, a startup that collects cryptocurrency transactional data using the blockchain. For most Twitter users, this move seems to facilitate the exchange’s spying on its customers.

However, Coinbase’s move to acquire Neutrino is, according to a Coinbase blog post, part of its goal to support all assets while complying with applicable laws. In addition to acquiring Neutrino, Coinbase has doubled the number of listed cryptocurrencies on its exchange since 2018. Coinbase’s aggressive listing approach has seen the addition of coins such as Dash, Cosmos and Waves, to mention just a few.

The company has almost constantly been making news throughout the year, from making acquisitions to denying them, as well as securing multiple patents along the way. Meanwhile, Coinbases’s Visa debit card solution has also seen exponential growth this year, now available for use in even more countries.

In May 2019, the company also expanded its reach to more than 100 countries while making its USDC stable coin — previously only available in the U.S. — available in 85 of those supported countries. In comparison, Coinbase was only available in about 32 countries last year. Its aggressive expansion appears to be in direct competition to other global players like Binance.

Binance ventures further

Ask any market analyst and they will admit that initial exchange offerings have grown into a big business in 2019. Reports have revealed a high demand for IEOs right from Q1 2019 to Q3, not to mention the fact that they collectively raised over $1.5 billion in the first half of 2019 alone. Unlike initial coin offerings, the biggest determining factor for a successful IEO is the availability of liquidity, and what better way to access liquidity than launching an IEO on a popular exchange.

That is why Binance and its native cryptocurrency BNB have had one of the best years yet. As one of the biggest marketplaces for digital assets, Binance enjoys a significant share of the trading volume. The exchange’s performance has been so exceptional that the Binance Coin has gained value by 150% over the year. When taking everything into account and considering year-on-year growth, Binance Coin has even slightly outperformed Bitcoin.

Also, Binance expanded its reach with the launch of a fully independent U.S. arm of its trading platform. Despite heavy regulatory pressure that keeps the Binance exchange in the U.S. from operating in states such as New York, the company’s partnership with BAM, a registered money service in the U.S., has so far given the exchange some leeway.

The losers

Facebook’s uncertain Libra launch in 2020

Facebook’s announcement of its Libra cryptocurrency has been one of the major events of 2019. However, on the unveiling of Libra as a stablecoin backed by a select number of national currencies, U.S. lawmakers reacted with skepticism, summoning Facebook CEO Mark Zuckerberg to multiple hearings.

Related: What Is Libra? Breaking Down Facebook’s New Digital Currency

At its core, Libra is a stablecoin backed by real money and lets users buy, sell and send money at nearly zero fees across borders. According to the project’s white paper, Libra’s overall mission is “to enable a simple global currency and financial infrastructure that empowers millions of people.”

Libra’s white paper further claims that it will use “a new decentralized blockchain, a low volatility cryptocurrency, and a smart contract platform” to empower about 1.7 billion unbanked people. This will be achieved through the use of Facebook’s WhatsApp, Messenger and Calibra, which is a digital wallet designed for Libra users.

Despite Libra’s ambitious plan to empower the unbanked, the Libra project has not only come under heavy scrutiny from lawmakers but also faced internal problems of its own. While sharing his thoughts with Cointelegraph, Ballet wallet’s Lee expressed optimism about Libra, saying that although “legislators and regulators in the United States and Europe understand that non-government currencies are a threat to their power, government opposition will diminish over time.” Lee further explained:

“Governments will change their stance because they will come to understand that they can’t control or stop Bitcoin, and they will prefer to have their citizens use centralized corporate coins that can easily be regulated, monitored, and pegged to fiat currency.”

Despite Libra’s ambitious plan to empower the unbaked, the Libra project has not only come under heavy scrutiny from lawmakers but also faced internal problems of its own.

The U.S. Congress has asked Facebook to pause further development of the Libra projects, and cynics now believe that the project will not get out of the starting blocks without the government’s approval. Multiple European countries have also spoken out against the proposed cryptocurrency, while China announced that it will soon launch its own stablecoin, a national central bank digital currency, likely as a retaliatory measure. Furthermore, in the wake of increased scrutiny from government regulators, some of Libra’s high profile backers like Visa, eBay, MasterCard and PayPal have abandoned the project.

A rocky year for Circle

In October 2018, Circle, a cryptocurrency firm based in Boston and backed by Goldman Sachs teamed up with Coinbase to launch the Centre consortium. Counting on its reputation as one of the most well-funded crypto startups, the two companies aimed to help accelerate adoption of cryptocurrencies. Through the Centre consortium, Coinbase and Circle would increase liquidity to the crypto industry through the issue of a stable coin called the USD Coin.

In July this year, Coinbase and Circle broadened participation into their consortium in a move that will allow other financial entities interested in the project to issue the USD Coin. In the announcement, the Centre network mentioned that “a natural next step is to imagine a new global digital currency” that would include a basket of tokens backed by a variety of stablecoins. Simply put, Centre’s plan is to go with a Facebook-like approach to create a global currency.

However, Circle has had a rocky experience throughout 2019. Even though the USD Coin has received a positive reception, with Centre claiming that the stablecoin has been used to clear on-chain transfers worth over $11 billion, Circle closed its mobile app, reduced its fundraising goal by 40%, and laid off 10% of its staff between May and June this year. Just recently, the company let go of 10 more of its employees, citing efforts to streamline its services.

The latest news of layoffs from Circle comes after the recent transition of the company’s co-founder Sean Neville from his position as CEO to a seat at the company’s board of directors. However, a representative of Circle has denied any connections between the recent layoffs and Sean’s transition, telling Cointelegraph that:

“None of this is related to Sean transitioning out of the co-CEO role. Sean will continue to serve on Circle’s board.”

Craig Wright’s court battles

When Australian-born technologist Craig Wright claimed to be Satoshi Nakamoto back in 2015, most people in the crypto community were skeptical and thought nothing of it.

Most people expected that the Satoshi Nakamoto impersonator would have scurried back into obscurity by now. However, Wright and his claims have continued to headline the news throughout 2019. Wright claims that he invented Bitcoin a decade ago and mined over 1 million BTC along with his late business partner Dave Kleiman. After Kleiman’s death in 2013, Wright claims that he put the mined Bitcoin in the “Tulip Trust.”

However, the Australian entrepreneur and computer scientist was sued by Kleiman’s estate in 2018 for allegedly stealing up to 1 million Bitcoin. In the past, it is said that Wright and Kleiman worked together on mining and developing Bitcoin. According to Kleiman’s family, Wright stole between 550,000 to 1 million Bitcoin — worth about $10 billion.

The ongoing case led to Magistrate Judge Bruce’s ruling that ordered Wright to turn over half of his Bitcoin holdings and intellectual property from before 2014 to Kleiman’s estate, presuming he is indeed Nakamoto. On Oct. 31, the trials re-emerged after Wright pulled out of the settlement agreement to forfeit half his Bitcoin and intellectual property.

In addition to his court battles, Wright was scrutinized by the crypto community after presenting what was considered forged documents as evidence of him being Nakamoto in another case of Wright against Peter McCormack. Wright’s case against McCormack is based on the fact that McCormack’s repeated statement that Wright is not Satoshi is harmful to Wright’s reputation. Most recently, Wright presented another document that allegedly proves how he came up with the Satoshi Nakamoto pseudonym.

Bitcoin ETF’s continual rejection by the SEC

Even though U.S. regulators have always left a window for the possibility of approving Bitcoin exchange-traded funds in the future, up until now, every single attempt to license a Bitcoin ETF has been met with failure. In October this year, an ETF proposal filed by Bitwise Asset Management in conjunction with NYSE Arca was rejected by the Securities and Exchange Commission for failing to meet legal requirements that prevent illicit market manipulation.

In fact, all Bitcoin ETF proposals presented to the SEC have been rejected on concerns about fraudulent activities and market manipulation. One of the main criteria for approving an ETF is establishing the underlying market of a new commodity-based ETF.

Related: The SEC Does Not Want Crypto ETFs — What Will It Take to Get Approval?

If the underlying market is resistant to manipulation, regulators can give the ETF the go-ahead. Given the complexities of the Bitcoin market, it seems approval from the SEC is unlikely. Despite the earlier rejection of Bitwise’s application, the SEC later announced that it would review Bitwise’s proposal once again.

While speaking to Cointelegraph on the realistic timeline of the first Bitcoin ETF approval, Charles Lu, the CEO of the Findora fintech toolkit provider said, “For a Bitcoin ETF proposal to gain SEC approval, the sponsor will need to prove that real price discovery is happening as opposed to market manipulations.” In Lu’s opinion, this will not happen anywhere soon, since the SEC would require “surveillance sharing agreements” with the big exchanges.

2019 and 2020

Overall, the crypto industry has shown some significant growth over the past year. Although volatile, Bitcoin is showing significant signs of growth. More institutional investors are looking into the industry to find more ways to invest as well. Even though there is a downtrend in market cap and trading volumes, prominent traders believe that a turn of fate might just be around the corner, especially for Bitcoin holders.

Out of all the winners and losers of 2019, perhaps Facebook Libra is one that stands to be most impactful in 2020. For most onlookers, it will be interesting to see whether Facebook’s Libra project will turn a new leaf and launch successfully in 2020. If it does, there is a high likelihood that big changes will take place throughout the entire industry.

America 2.0 is what I call the coming cultural, technological and economical shift. This is what I am most excited about: it’s an investment strategy for 2020 that I will be discussing often. In many ways, America 2.0 is really what I have been calling a Lollapalooza Effect.

America 2.0 is what I call the coming cultural, technological and economical shift. This is what I am most excited about: it’s an investment strategy for 2020 that I will be discussing often. In many ways, America 2.0 is really what I have been calling a Lollapalooza Effect. I know there are many people out there that focus on the negative and fear of the future to get ‘clicks’— I read MarketWatch, Yahoo! Finance and the Wall Street Journal. The financial media that I sometimes refer to as the bad news media is making some pretty bold claims. It often does seem that they focus almost exclusively on bad news.

I know there are many people out there that focus on the negative and fear of the future to get ‘clicks’— I read MarketWatch, Yahoo! Finance and the Wall Street Journal. The financial media that I sometimes refer to as the bad news media is making some pretty bold claims. It often does seem that they focus almost exclusively on bad news. With respect to the overall market in 2020, I’m still optimistic.

With respect to the overall market in 2020, I’m still optimistic.