Timor Invest

https://ift.tt/2vYOEX1

There’s an Ordinary World…

Somehow I have to find. And as I try to make my way to the ordinary world, I will learn to survive.

I hope you like spending time with your family, ‘cause we’re in for another month of social distancing.

As part of his regular COVID-19 briefing to the American people, President Trump called for another month of voluntary shutdown. The original 15-day period of official social distancing would’ve ended today. But Trump extended the shutdown, calling his earlier hopes for an Easter revival “aspirational.”

Sorry, Easter Bunny, we’re busy looking for coronavirus infections … no time for eggs this year.

At least … outside. You can still hide those suckers in the house. Just don’t lose any. That “forgotten rotten egg under the couch” smell isn’t something you want to experience … trust me.

Perhaps Trump’s most striking admission was that the coronavirus pandemic could infect millions in the U.S. and claim 100,000 to 200,000 lives.

“It’s a horrible number,” Trump said in the understatement of the year, noting that the country would do well if it “can hold” the number of deaths at 100,000. I’m not sure that his version of “doing well” is the same as mine … or yours, for that matter.

However, Trump said one thing that I think we can all agree on right now: “I want our life back again.”

The Takeaway:

It’s a simple statement that carries so much weight: “I want our life back again.”

After 15 days of social distancing, only leaving the house for necessities, “visiting” the grandparents via the cold impersonality of video chats and scouring the earth for anything that resembles toilet paper … we all want nothing more than a return to normalcy.

A return to the mundane, boring life of wildfires, threats of World War III and China trade wars. You know … the good ol’ days.

Unfortunately, there’s no spiffy trading chart for COVID-19. There’s no true way to distance your life or your portfolio from the pandemic’s full impact.

All we can really do is hunker down and ride out the storm … while playing a few hundred games of Uno with your family. (My youngest has an Uno obsession that has only grown bolder with all of us locked in the house with her. I think it’s time to teach her euchre.)

As for your investments, you should fare pretty well right now … if you moved into gold, bonds and currencies like Great Stuff suggested. Yes, there are opportunities to be had — especially in biotech and social-distancing technology companies.

The biggest point I want to make here is that you need to maintain your wealth. That way you’ll have the capital to reinvest when the market turns around (and we finally have our lives back again).

And, if you’re still unsure of how to prepare for this volatility … it’s beyond time to watch this message from a former Washington insider. Click here now!

Good: Wake Me up When September Ends

It seems that every drugmaker and biotech firm worth its salt is working on a COVID-19 vaccine these days.

So, it should come as no surprise that Johnson & Johnson (NYSE: JNJ) — a drugmaker with no real history in the vaccine market — announced that it too has a vaccine candidate. The company said today that it will begin clinical testing on humans in September, and that the vaccine should be ready early next year.

Now, I know what you’re thinking … we’ve heard all this before. But what makes Johnson & Johnson different is that it’s already mass-producing the vaccine — just in case the testing proves successful. That way there will be plenty of the vaccine ready to go, once it’s approved.

Furthermore, Johnson & Johnson will make the vaccine available “on a not-for-profit basis.”

These are bold moves from a big drugmaker with deep pockets. While Johnson & Johnson reportedly won’t profit from the vaccine — if it’s successful — that’s a lot of goodwill and marketing the company can bank on for decades to come.

JNJ isn’t a wow kind of investment, but if the company is successful on the vaccine front, it would bolster the buy-and-hold case for Johnson & Johnson coming out of this pandemic.

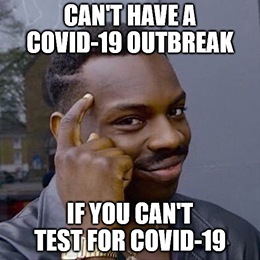

Better: Test for Echo

Any biotechs that aren’t racing to find a vaccine are more than likely racing to find a fast, reliable COVID-19 test instead.

The latest entry into the speedy coronavirus-testing race is Abbott Laboratories (NYSE: ABT). Today, Abbott unveiled a small, portable five-minute test.

“This is really going to provide a tremendous opportunity for front-line caregivers, those having to diagnose a lot of infections, to close the gap with our testing. A clinic will be able to turn that result around quickly, while the patient is waiting,” said John Frels, vice president of research and development for Abbott Diagnostics.

The company plans to make 50,000 tests per day beginning April 1 … no fooling.

What’s more, the U.S. Food and Drug Administration gave Abbott emergency authorization to roll out the new test “for use by authorized laboratories and patient care settings.”

Now, Abbott’s test isn’t as convenient as Astrotech Corp.’s (Nasdaq: ASTC) BreathTest-1000, but Abbott has the resources and capital to roll out its test at a much faster rate.

I think this is the same reason why Sony Corp.’s (NYSE: SNE) Betamax lost out to VHS from the get-go. Anyone still have a Betamax player out there?

Best: Hoarding Profits

If you’re still struggling to find suitable bathroom tissue, like my family is, I don’t have a solution for you … unfortunately. (Knock over those books one more time, cats, and you’ll really wish you hadn’t…)

What I can offer you, however, is a way to profit from all those annoying hoarders: Invest in the companies that make toilet paper and other hoard-able goods.

For instance, Procter & Gamble Co. (NYSE: PG) and Kimberly-Clark Corp. (NYSE: KMB). Both companies make a plethora of goods favored by hoarders, including toilet paper. And both stocks saw upgrades from “hold” to “buy” at Jefferies this morning.

The ratings firm cited short-term benefits from the hoarding movement surrounding COVID-19, noting that P&G could see 5% organic sales growth heading into a likely recession.

One of the best investment sectors when heading into (and during) a recession is the consumer goods sector. With both P&G and Kimberly-Clark getting a head start on sales, both are solid choices to add to your short list for investment ideas.

Or, as Jefferies puts it, these stocks are “among the best in staples to weather near-term macro headwinds.” I like my wording better, but whatever floats your boat…

By the way, if you’re a real technical investing kind of junkie, this P&G article on Investopedia will hit all your buttons.

Germans could soon be issued “immunity certificates” that would allow them to leave the country’s coronavirus lockdown earlier than the rest of the population if they test positive for antibodies to the virus.

— Adam Bienkov, Business Insider

A lot of reactions to COVID-19 have given me the heebie-jeebies. We’ve seen everything from quarantines locking down millions of people to companies paying workers with cash cards (which, with their “nominal processing fees,” seem like some weird reinvention of the company coupons that coal-mining firms used to use way back in the day.)

But this idea of “immunity certificates” coming out of Germany (of all places) really sparked a knee-jerk reaction for me.

I get that they want to make it so that immune people can get back to work, but the last thing anyone wants to hear in German right now is “papers, please.”

Great Stuff: Get Back Jojo

So, we have a president pining for rosier times, the Dow creeping back to positive ground and Johnson & Johnson offering future vaccines gratis.

Now, you know by now that I’m not a guy to look a gift rally in the face — to mix metaphors here. I still think we’re headed for trouble (and make it double). Yet, today’s broad move higher and the growing green in my account are a refreshing bit of optimism.

Around here, that careful optimism has another name: Paul Mampilly.

To Paul, this pandemic crash is an ultra rare opportunity to build your wealth beyond what you’ve ever dreamed. And his Strong Hands approach to investing is crucial for times like this. Paul believes America will emerge from the coronavirus stronger than ever … no matter how long it takes.

If you have yet to hear Paul Mampilly’s vision for a rebuilt United States — America 2.0 if you will — don’t wait until we “get our lives back again.”

Click here to learn more now.

Though, I hear you, dear reader. You want more. More Paul Mampilly. More of Paul’s world-famous trade research. More ways to put the market’s whipsaws in your favor.

Why, it’s a veritable “Mampilly Monday” here at Great Stuff!

And for good reason: Paul Mampilly’s “rebound” method looks for specific opportunities in volatile markets just like these. Little clues can show Paul manipulations going on behind the scenes … and turn in a solid profit.

Paul’s “rebound” strategy is so powerful — How powerful is it?! — that historical data shows it could’ve made you 529% during the worst month of the 2008 crash. (Now how’s that for powerful?)

Before midnight EDT, click here to learn exactly how Paul’s strategy works. Though, I have to warn you to act quickly. Today’s the only day you can click this link here.

Now, if you’ll excuse me, I have to set up what’s sure to be another riveting game of Uno. Don’t forget, you can always check Great Stuff out on social media: Facebook and Twitter.

Until next time, good trading!

Regards,

Joseph Hargett

Editor, Great Stuff