https://ift.tt/2VPuN7n

[Update]

After stocks fell enough last week to call it a correction — a 10% drop in stocks from their most recent peak — investors are once again panicking.

This time, the markets are worried about a coronavirus outbreak.

The CBOE Volatility Index, aka the Fear Index, rose to highs last week that it hadn’t seen since 2008.

I know I felt a little worried the past couple of times I’ve looked at my retirement account.

But this safe strategy — with a win rate of over 90% and an almost unbelievable string of recent, steady gains — might be the best one on out there for times of market panic.

Just take a look at the positions they’ve closed in the model portfolio since July 2019. Yes, you’re reading that correctly — zero losses!

Read on to find out all about this easy-to-follow, three-step strategy.

For much of my early life, I wondered if my family would have enough to retire.

If you’re like I used to be, you often checked your account balances with one eye closed.

I’ve started paying closer attention in recent months.

Between the U.S.-China trade war, yield curve inversions, the Federal Reserve’s interest rate cuts and other market-moving news, maybe — like me — you’ve told yourself: “There has to be a better way to make income for (or during) retirement.”

It’s tough to bear the dips when you’re a passive investor.

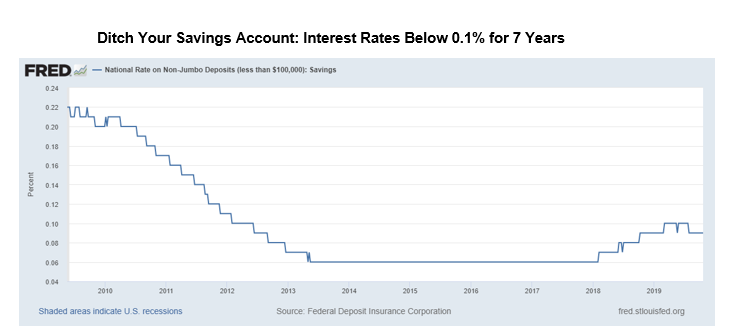

But letting your money sit in a savings account isn’t any better.

As you can see in this chart from the St. Louis Federal Reserve, the average interest rate is less than 0.1%.

That doesn’t look likely to change much anytime soon.

Here’s what you need to know, though: There is a more lucrative way to make income — whether you’re 20 years into retirement or just building your nest egg.

My colleague — and Chartered Market Technician — Chad Shoop has been demystifying options trading for his readers for years. I know many new traders who’ve sworn off options after one or two trades.

Their problem?

Doing it alone.

Chad’s readers stick by his guidance to navigate the options markets.

And this income strategy’s 90%-plus win rate seals the deal for me.

If I’m putting money in a strategy (even one as simple to understand as Chad’s), I want to know my profits before clicking “buy.”

Now, this strategy involves three easy steps.

Step 1: Find a Stock You’d Like to Own

This one seems obvious.

Make sure you’re only making trades on stocks you’d like to own.

But with Chad’s strategy, you aren’t at the mercy of the market’s pricing. You get to choose the price at which you want to buy the stock!

Step 2: Do the Math

Now, this step involves some math.

It’s worth it, though. And it’s simple division.

OK, full disclosure: If you follow Chad’s service, he does the math for you.

But you don’t need to be a Chartered Market Technician to figure it out on your own.

Chad will give you the price he wants to pay for the stock and the current price of the trade he’s recommending.

You’ll divide the current price by the price at which you’re willing to buy the stock. Make sure it’s at least 3%, because that’s how much profit you’ll make on the trade.

(In some instances, it will be 10% — or more! Chad unveiled a bonus strategy early this month with a 10.8% yield. And he told readers they could expect one bonus trade every month!)

Step 3: Wait 90 Days

Chad studied countless stock charts and did the work for us.

He determined that the “sweet spot” — the best balance of risk and reward — is about three months.

So, that yield you calculated in step 2? You’ll make that income — and you’ll get one of two results:

- You’ll buy the stock you wanted to buy at the price you wanted to buy it within 90 days. (That’s why step 1 is so important.)

- Or you’ll collect your income, the trade will expire in about three months — and you can roll that cash into another trade on the same stock (or a different one)!

Bonus Step: Repeat Every Week!

Now, this isn’t a one-time deal.

Chad recommends a new trade nearly every Wednesday!

So that income you’re collecting — whether it’s 3% or 10% — adds up fast.

In no time, you’ll be crushing the previous returns in your retirement account! (And yes — you can take advantage of this strategy with many individual retirement accounts.)

Take a look at what one of Chad’s readers told him after Chad revealed his bonus trade strategy:

If “put selling” sounds intimidating to you, Chad wrote a great primer on what it means a few weeks ago. You can read it here.

For a limited time, we’re inviting new readers to join Chad’s premium Pure Income service.

You can join Jim and all of Chad’s other happy readers with this easy-to-follow strategy.

In fact, you won’t even have to memorize these three steps. Chad’s informative trade alerts take care of it all for you, right down to figuring out your profit potential.

And to make sure it’s as simple as possible, for a limited time, we’ll send you a brand-new laptop loaded with everything you need to follow Chad’s system.

If you decide, for any reason, that Pure Income isn’t for you, the laptop is yours to keep. Click here to learn more.

Good investing,

Kristen Barrett

Senior Managing Editor, Winning Investor Daily

This article was updated on March 7, 2020.

Комментариев нет:

Отправить комментарий